The Risks Facing Toronto's Housing Market

Toronto’s housing market in 2024 remains a topic of concern and interest for both local residents and global observers. The city is facing a significant risk of a housing bubble, with prices continuing to outpace income growth, making it increasingly difficult for many people to afford homes. According to the 2024 UBS Global Real Estate Bubble Index, Toronto ranks fifth worldwide for bubble risk, following cities like Miami and Tokyo. This is a slight improvement from previous years, but the market remains volatile and unpredictable. Several factors are contributing to the housing market’s instability, including limited housing supply, speculative investments, and rising inflation. These challenges have created a disconnect between home prices and what people can afford. For example, the cost of buying a home in Toronto is far beyond the reach of many, with housing prices growing at a much faster rate than local incomes. As interest rates fluctuate, the market could see renewed price increases, further complicating the situation. While efforts such as foreign buyer restrictions and increased inventory may slow growth, the city’s housing market is still at risk of significant disruption. This situation not only affects potential homeowners but also has broader implications for the real estate industry and the Canadian economy. Understanding these risks is key to handle the complexities of Toronto's real estate market in 2024. The housing market's instability in Toronto also affects related industries, including furniture and professional moving services. As home prices continue to rise, many people are forced to downsize or delay moving, reducing demand for furniture and moving services. However, frequent relocations due to market volatility can still create opportunities for professional movers, though at unpredictable level

Understanding Toronto’s Real Estate Bubble in 2024

Toronto’s housing market in 2024 continues to raise concerns, with home prices rising much faster than incomes, making it hard for many people to afford homes. According to the 2024 UBS Global Real Estate Bubble Index, the city ranks fifth in the world for housing bubble risk, behind cities like Miami and Tokyo. While this marks a slight improvement from previous years, the market remains unstable and unpredictable. Several factors are driving this instability, including a limited supply of homes, rising inflation, and speculative investments. These issues have caused home prices to skyrocket, far outpacing the ability of many locals to buy a home. As a result, the gap between what people earn and what they can afford has become much wider. With fluctuating interest rates, home prices could rise again, making the situation even more challenging. While measures like restrictions on foreign buyers and an increase in housing inventory might slow things down, Toronto’s housing market still faces the risk of major disruptions. This not only impacts potential homebuyers but also has wider effects on the real estate industry and the Canadian economy. Understanding these risks is crucial for anyone looking to enter Toronto’s housing market in 2024.

The Drivers Behind the Housing Bubble

Three key factors often lead to housing bubbles: speculative investment, limited housing supply, and low interest rates. In 2024, Toronto’s housing market is experiencing all of these challenges. Between 2002 and 2022, housing prices in the city skyrocketed due to strong population growth, affordable financing options, and high demand from investors. However, since 2022, inflation and economic uncertainty have changed the situation. Despite these shifts, the risks in the housing market remain high, leaving the city vulnerable to further instability. The combination of these factors continues to put pressure on Toronto’s real estate market, making it harder for many to afford homes.

Why Home Prices Are Disconnected from Incomes

A key problem in Toronto's 2024 housing market is the growing gap between home prices and local incomes. According to the UBS report, home prices are no longer sustainable given current interest rates. For example, a skilled worker would need six years of income to buy a small 650 sq. ft. apartment in downtown Toronto. In comparison, renting that same apartment would take 25 years of income. This huge difference shows that the market is becoming unsustainable, as home prices have risen much faster than wages over the past few decades. This disconnect between home prices and local incomes also has a significant impact on related industries like furniture and moving services. With fewer people able to buy homes, many are either delaying purchases or opting for smaller living spaces. This reduces demand for new furniture, as people hold off on upgrading or downsizing. Professional movers and furniture assemblers are also affected, as the frequency of home moves decreases. Those who do relocate may choose to use less expensive, smaller furniture, further limiting demand in these industries. The result is a slow-down in business for furniture stores and moving companies, which must adjust to these market shifts in 2024.

The Impact of Interest Rates on the Market in 2024

In 2024, interest rate fluctuations are a key factor affecting Toronto's housing market. Since 2022, inflation has caused home prices to drop by about 10% in real terms year-over-year. However, if interest rates fall again, more people, particularly first-time buyers, may look to purchase homes, leading to a rise in demand. This increased demand could drive home prices back up, starting a new cycle of rising prices and making homes even less affordable. As prices increase again, the affordability problem will likely return, creating challenges for potential buyers. This cycle of rising prices could worsen the risks in the housing market, making it more difficult for people to find homes within their budget. With

affordability

already a concern, any price increases could push homeownership further out of reach for many. As the market remains sensitive to interest rate changes, the risks of instability and reduced affordability may continue to grow in the coming months.

The Broader Implications for the Real Estate Industry

Toronto’s housing market in 2024 is having a significant impact on areas beyond the city. The price difference between homes in Toronto and other parts of Canada shows that Toronto's high home values are influencing the broader national market. As home prices in Toronto remain inflated, this trend is spreading to other regions, raising concerns about a potential housing bubble across the country. This situation creates challenges for both potential homebuyers and the real estate industry. For buyers, it means that finding affordable homes is becoming more difficult not only in Toronto but in other Canadian cities as well. As prices rise, it becomes harder for many people to enter the housing market, especially first-time buyers. For the real estate industry, this shift presents a difficult task. Professionals must deal with fluctuating market conditions and changing consumer expectations. With the spread of high home prices, buyers are becoming more cautious, and sellers may face challenges in finding buyers willing to pay inflated prices. The housing market’s instability is forcing both buyers and real estate experts to adapt to new economic realities. This makes navigating the Canadian real estate market in 2024 increasingly complex for everyone involved.

Underlying Mortgage and Construction Risks

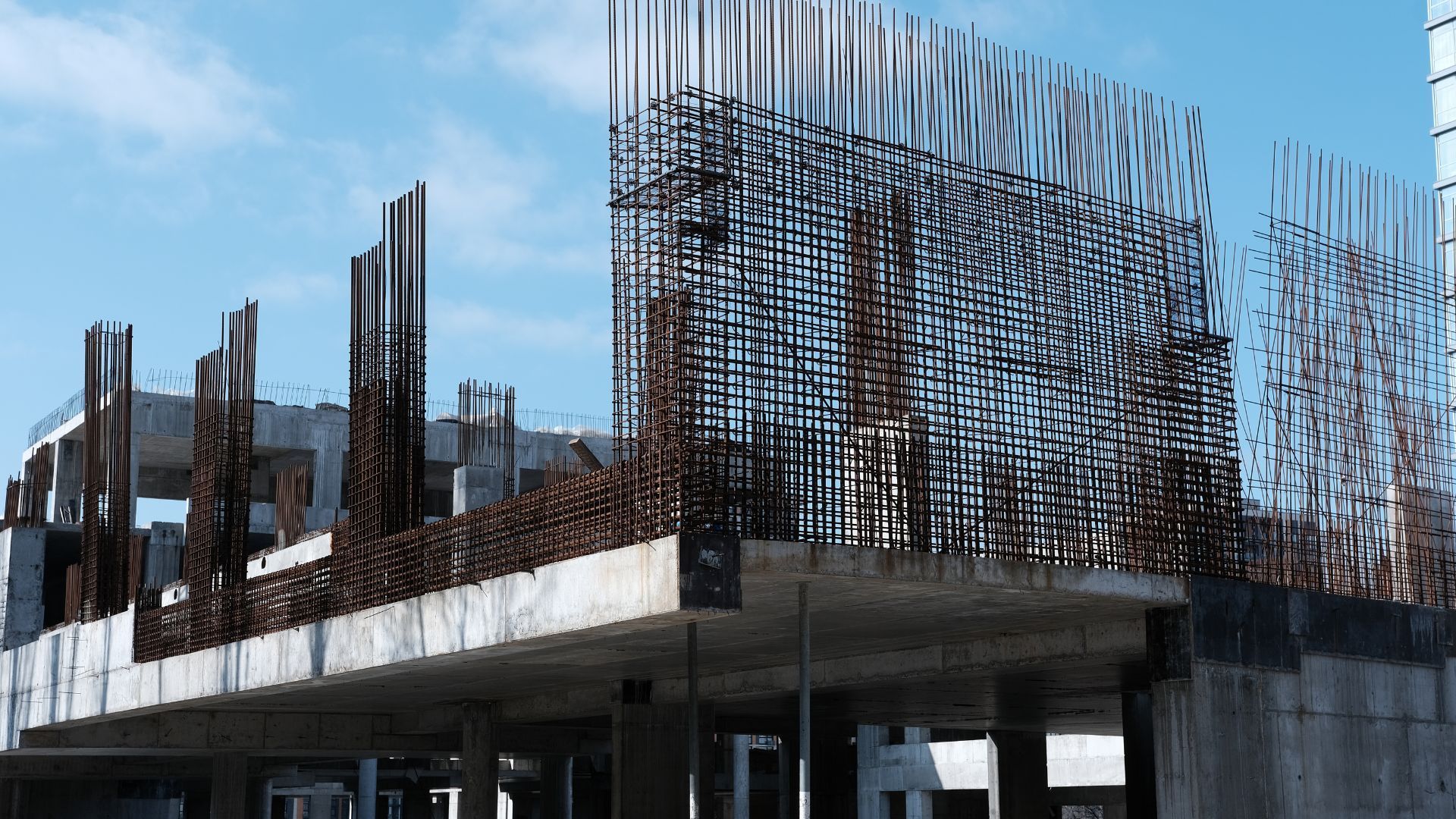

UBS’s 2024 analysis suggests that, on a national level, Toronto’s mortgage risk and

construction activity seem stable. However, this view overlooks local issues that could create hidden risks. One concern is the rise in mortgage delinquencies, where homeowners are struggling to keep up with payments. Additionally, more people are turning to high-interest private loans, which can increase financial strain for both homeowners and lenders. While

construction activity remains steady, this could be masking other problems in the housing market. For instance, rental vacancies are on the rise, which indicates that there may be a mismatch between the number of homes being built and the actual demand for them. This could mean that the housing supply is not aligned with what people truly need, which may cause further instability in the market. These local factors, including rising delinquencies and the shift toward expensive loans, add layers of risk that aren’t fully reflected in broader national data. As a result, while the overall market might seem stable, the real situation could be more complex, with potential financial challenges ahead for both homeowners and lenders in Toronto.

What Lies Ahead for Toronto’s Real Estate Market in 2024

Although Toronto’s housing market risk score has improved slightly in 2024, it remains in a fragile state. The high price-to-rent ratios, the possibility of interest rate cuts, and ongoing economic uncertainty suggest that the market is still vulnerable to major disruptions. While measures like foreign buyer restrictions and increased housing inventory may help slow down the rapid price growth, they may not be enough to balance the strong demand fueled by lower interest rates. The combination of these factors creates an unpredictable environment where home prices could continue to rise, making affordability a growing challenge for potential buyers. Even though there are efforts to manage the market, the continued demand, especially from those taking advantage of lower rates, could keep pushing prices higher. As a result, while the market is not as risky as it once was, it is still susceptible to instability, and the long-term outlook remains uncertain.

Toronto’s real estate continues to challenge both industry professionals and buyers, reflecting broader issues within global urban markets. With home prices fluctuating and affordability remaining a key concern, the housing market’s instability also impacts the furniture industry. As people face higher prices and shifting housing needs, demand for new furniture may slow, with many opting for smaller, more affordable pieces. Professional movers and furniture assemblers may also see fluctuating business levels, as fewer people move or buy new homes. As the city is going through this complex situation, staying informed and prepared for potential changes is crucial for all stakeholders involved, including those in the furniture and moving industries.

MaxxDelivery Moving and Delivery Tips and Blog